WHAT TO EXPECT – MORTGAGES

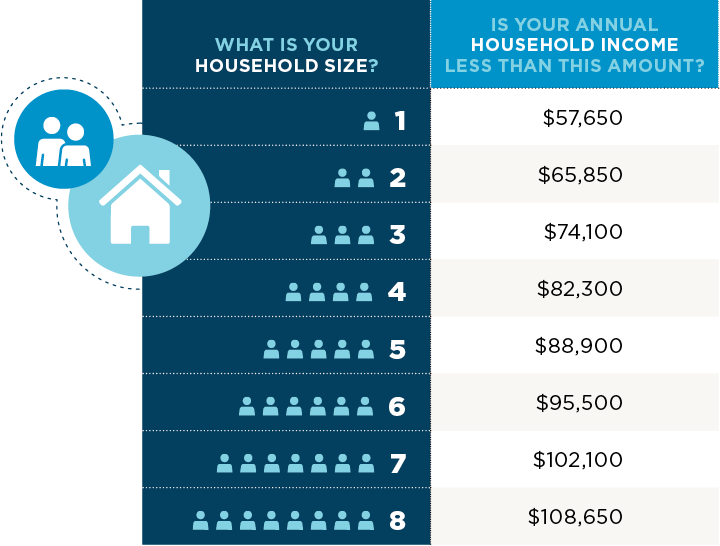

From pre-qualification to applying for a home loan, INHP will help you every step of the way. Here’s what to expect when you get started with INHP’s home loan program:

REGISTER ONLINE AND PROVIDE DOCUMENTATION

Once you complete registration, INHP's lending team will check your bank statements, pay stubs, tax returns and more to determine if your finances are ready to make a home purchase.

GET PRE-QUALIFIED

If your finances are in order, you will get pre-qualified, either through INHP as the lender or through one of INHP's partnering lenders who offer additional mortgage options for INHP clients.

CHOOSE A MORTGAGE

INHP's lending team will give you unbiased advice and will help you decide what type of mortgage might be best for you and your financial situation — with no pressure.

CHOOSE A HOME

Work with a real estate agent to find a home that meets your needs and budget. Then, your real estate agent will help you make an offer on the home and negotiate a purchase price.