Learn Home Loan Lingo Fast with INHP

Buying a home for the first time – or even the hundredth time – can be intimidating. But once you learn the homebuying lingo, it’s much easier to make decisions that work best for your life and budget. Here are a few terms to get you started:

- Lender – a bank or other financial institution, like INHP, that loans money to people to buy a house – the loan is often called a mortgage;

- Principal – the amount of money borrowed to buy a house;

- Interest rate – the amount a home the lender charges for borrowing money. It’s how the lender makes money from doing a transaction with you;

- Fixed-rate mortgage – a mortgage with a fixed interest rate and payments that remain the same throughout the life of the loan;

- Earnest money – a “good faith deposit” given to the seller to show you are serious about buying the home;

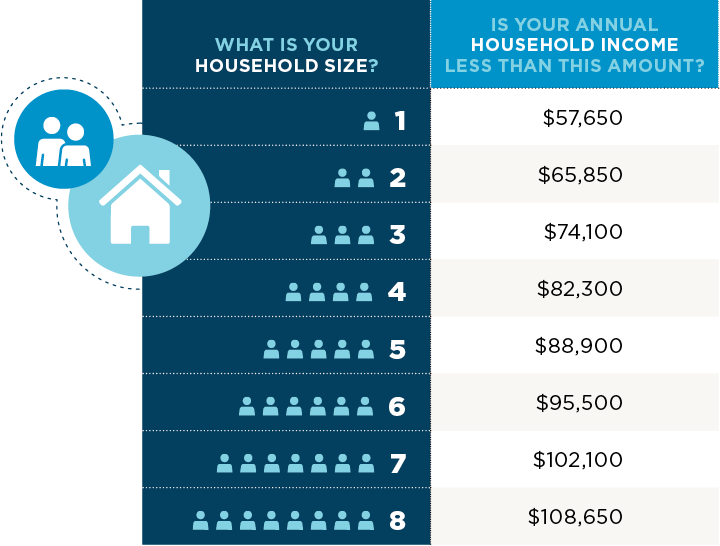

- Down payment – the amount of the home’s purchase price paid upfront and not included in the amount of the loan. For first-time homebuyers, it’s usually 6% of the home’s price. INHP clients who meet certain income requirements, may be eligible to receive thousands of dollars in down payment assistance (DPA) funds to reduce this expense.

To learn more about the home buying process, including the lingo, sign up for one of INHP’s classes online. Most are free.