Three Tips for Buying a Home in Fall

While spring might be considered official homebuying season, there are good reasons for home shopping this fall. The first – and most timely – is the recent cut to interest rates by the Federal Reserve (the Fed) for the first time in four years. This is a huge win for homebuyers in terms of making housing more affordable over the lifetime of the loan. Fall home shoppers also often experience less competition, so sellers are more willing to negotiate. Additionally, even moving costs can be offered at an off-season rate during the fall.

Here are three tips to help you explore your homeownership potential this fall:

Assess your finances:

Find out if you’re financially prepared to buy a home with INHP’s online and in-person classes, many of which are free. Learn how to manage your daily finances, save money and increase your credit score.

Explore your options:

Comparison shopping for a mortgage can save you money. Find out how much you can comfortably afford by scheduling a lender options appointment with one of our unbiased expert mortgage loan originators.

Save for a down payment:

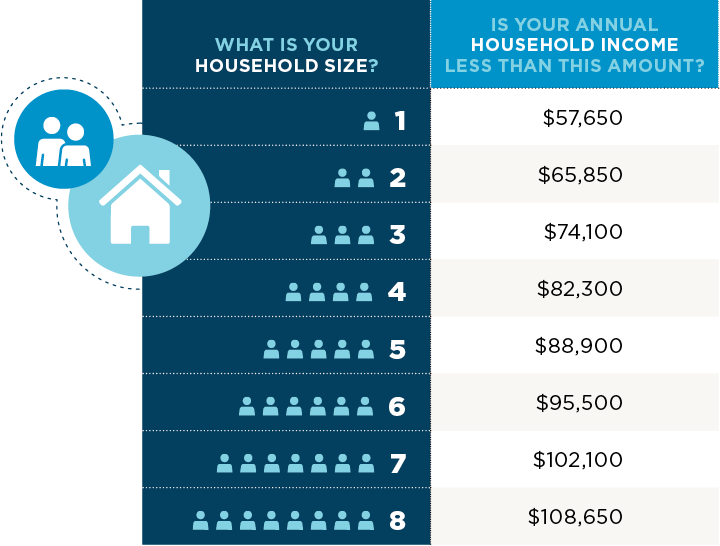

For many homebuyers, saving for a down payment is the most intimidating part of the homebuying process. Through INHP’s Down Payment Assistance program, you could qualify for up to $14,999* in Down Payment Assistance to buy a home in a neighborhood you love.

Register today! Down Payment Assistance funds are first-come, first-served through Dec. 31, 2025.

*Subject to the program eligibility, income certification and availability of funding.