RENT-FOCUSED MORTGAGE LENDING

If you currently have a good rental history, don’t let credit barriers keep you from pursuing homeownership. We know there are successful renters who are capable of being successful homeowners when given the right opportunity.

PROGRAM DETAILS

ADDRESSING THE CHALLENGES

It’s common for renters to begin exploring homeownership only to be stopped by their credit challenges. Even if you’re committed to paying your rent bill each month, you might feel stuck in a long-term rental situation because your credit isn’t perfect.

Our Rent-Focused mortgage lending program addresses this barrier. INHP’s lending team can assess a mortgage applicant’s rental history, while factoring in the extent of other financial barriers, to better understand the applicant’s situation and determine if homeownership may be a sustainable option.

PROGRAM ELIGIBILITY

24 consecutive months of on-time rental payments

Minimum 580 credit score

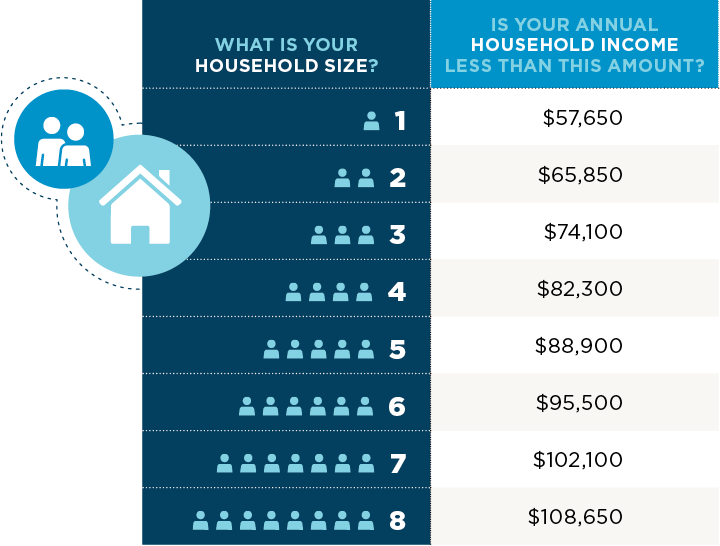

Household income below 120% of Area Median Income (AMI)

Zero money down

$500 minimum closing cost contribution

Home purchase must be in Marion County and be the buyer's primary residence

*Estimated loan terms are based on a $200,000 Purchase Price, $200,000 Loan Amount (or 0% down), 6.686% interest rate (6.858% APR), 580 credit score, $1,288.70 monthly principal, and interest payment for 360 months. Income, eligibility, and other restrictions may apply. Rates and availability subject to change without notice.

Must earn a low or moderate income, defined by U.S. Department of Housing and Urban Development (HUD) (i.e. a household of three earning up to $111,150.00).