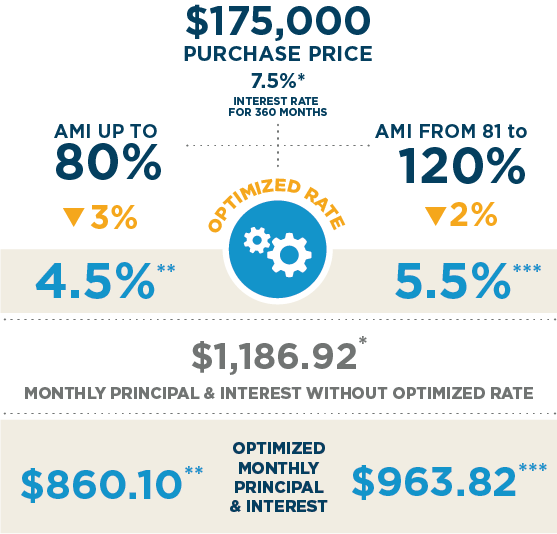

RATE OPTIMIZER

INHP can lower the interest rate on its standard 30-year-term mortgage loan so you can have a fixed, affordable and optimal monthly payment.

PROGRAM DETAILS

HOW DOES IT WORK?

The interest rate reduction is based on an eligible buyer's household income.

The rate will not be lowered more than 3 percentage points, and the rate cannot fall below 2%.

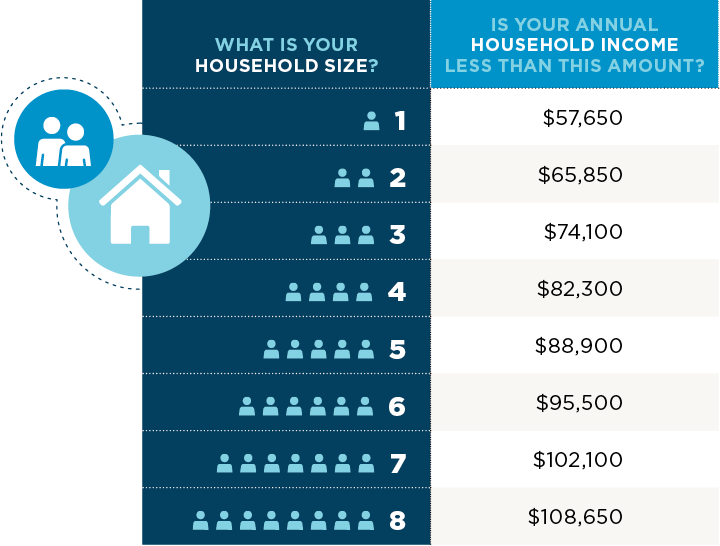

PROGRAM ELIGIBILITY

1 to 3% down payment

Minimum 580 credit score

Home must be primary residence in Marion County

Household income cannot exceed 120% AMI (inquire for more details)

*Estimated loan terms are based on a $175,000 Purchase Price, $169,750 Loan Amount (or 3% down), 7.5% interest rate (7.750% APR), 580 credit score, $1,186.92 monthly principal and interest payment for 360 months. **Estimated loan terms are based on a $175,000 Purchase Price, $169,750 Loan Amount (or 3% down), 4.5% interest rate (4.686% APR), 580 credit score, $860.10 monthly principal and interest payment for 360 months. ***Estimated loan terms are based on a $175,000 Purchase Price, $169,750 Loan Amount (or 3% down), 5.5% interest rate (5.705% APR), 580 credit score, $963.82 monthly principal and interest payment for 360 months. Income and eligibility restrictions apply. Rates and availability subject to change without notice.